In the following opinion abstract, which is taken from ” Increasing margins “ in Dawn, Published November 15, 2023, I aim to navigate through the intricacies of gender imbalance in financial inclusion, shedding light on its multifaceted implications. From socio-economic repercussions to potential solutions, this exploration seeks to foster a deeper understanding of the challenges faced by different genders in accessing financial services. Join me in this discourse as we unravel the layers of gender disparity and contemplate the transformative potential of more inclusive financial systems. Here is the link of the parent article:

https://www.dawn.com/news/1789463

Gender-Gap-In-Financial-Inclusion

Introduction

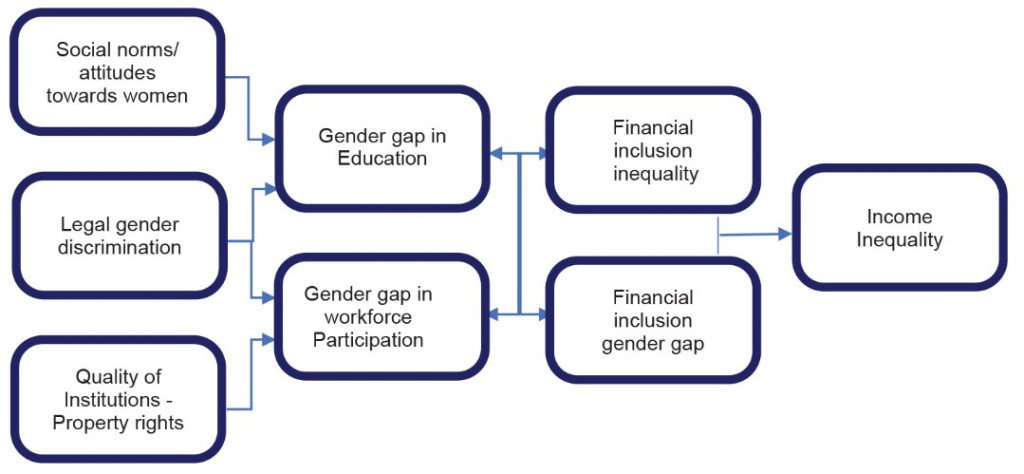

The economic turmoil in Pakistan stems from multifaceted factors, prominently inclusive institutions, and a dearth of equal opportunities. The consequence? Subdued productivity and a stunted economic growth trajectory. This adversity is further compounded by the exclusivity prevalent within the system, notably the limited avenues for entrepreneurship, especially among women, obstructing innovation and discouraging investments in more productive sectors.

Policy realization on the imperative need for sustainable and inclusive development has encountered a roadblock in addressing gender disparity and financial inclusivity. Pakistan’s policymakers have struggled to redress this issue, resulting in a glaringly untapped entrepreneurial potential among women.

Evidence from the Labour Force Survey

The data gleaned from the Labour Force Survey for 2020-21 paints a disheartening picture. A minuscule two percent of employers in Pakistan represent women, merely accounting for 0.1 percent of the total female workforce. Additionally, a staggering 60 percent of working women are categorized as contributing family workers, while a paltry 18 percent are own-account workers. These stark statistics not only spotlight the acute shortage of female entrepreneurs but also underscore the scarcity of meaningful employment opportunities available to women in Pakistan.

These figures significantly underline the pressing need for a paradigm shift towards gender-inclusive economic policies. The current landscape, dominated by limited entrepreneurial prospects for women, shackles the country’s economic growth potential and perpetuates the cycle of dependency on seeking employment rather than fostering an environment conducive to job creation.

Quelling the Struggle for Economic Empowerment

The plight of women engaged in toiling for meager wages or, in many cases, without remuneration, underscores the urgent requirement for systemic changes. Addressing gender disparity and enhancing financial inclusion can catalyze economic empowerment among women, transforming them from mere contributors to primary income earners and innovators within the economy.

Empowering women through targeted policies that offer financial support, access to entrepreneurial education, and creating an enabling environment for their participation in the workforce can pave the way for a more inclusive and sustainable economic landscape in Pakistan.

Empowering Women through Digitalization and Systemic Changes

Digitalization stands as a beacon of hope, promising enhanced access to markets for women in Pakistan. However, this promise is overshadowed by the concerning reality revealed by statistics. A staggering 70.5 percent of working women have never attended school, with a mere 6.25 percent having graduated with formal degrees. The existing training programs, tailored for women, predominantly focus on skill-oriented endeavors like tailoring, cooking, and beauty parlor training, neglecting the crucial aspect of entrepreneurship guidance. The absence of counseling on entrepreneurship perpetuates the cycle of limited opportunities for women.

Barriers to Economic Inclusion

The lack of access to credit or initial capital serves as a significant impediment, thwarting women from embarking on entrepreneurial ventures and creating avenues for meaningful work. Moreover, the dearth of safe and affordable transportation options further restricts women’s ability to engage in entrepreneurial activities. In Pakistan, women face constraints on mobility, necessitating permission and an escort for travel. While men have cost-effective transportation options like motorbikes and bicycles, women grapple with cultural restrictions, leading to their confinement at home or dependence on male accompaniment.

The prevailing cultural norms coupled with the unaffordability and safety concerns of various transport modes like rickshaws, Qingchis, and cabs confine women, curbing their economic agency. The notion of female travel via platforms like Bykea is marred by societal perceptions, further reinforcing the home-centric roles for women.

Policy Imperatives for Inclusive Growth

The gravity of these issues demands decisive action from policymakers. Historically, the government’s efforts to boost tax revenues have burdened the salaried classes without fostering sustainable revenue-raising mechanisms. However, a more pragmatic approach entails engaging the untapped potential of over half the population, currently constrained due to various societal, cultural, and economic factors.

Quelling the Cycle of Constraints

To break the cycle of limitations, policymakers must prioritize multifaceted solutions. Empowering women through educational initiatives, especially focused on entrepreneurship, and facilitating access to credit and capital can nurture an environment conducive to women-led economic initiatives. Addressing transportation challenges by ensuring safe, affordable, and culturally sensitive mobility options can liberate women from the confines of their homes and unleash their economic potential.

Reimagining Economic Contribution

Redefining the tax base by actively engaging women in the economy can be transformative. By alleviating the barriers that restrict women’s participation, Pakistan can harness a substantial workforce that remains untapped, augmenting not only economic growth but also fostering a more inclusive society.

The Transformative Potential of Digitalization for Women’s Economic Empowerment

The constraints confining women in Pakistan’s economic landscape find a promising solution in digitalization. The burgeoning e-commerce platforms offer a gateway for women to engage in economic activities securely from their homes. However, the efficacy of this solution hinges on bolstering digital access for women across key domains—device ownership, internet accessibility, and digital literacy—where they currently face substantial disadvantages.

Digital Access: A Gateway to Economic Participation

The pivotal role of digitalization lies in granting women seamless access to markets and fostering a nuanced understanding of opportunities for innovation and growth. Expanding device ownership and ensuring internet access while simultaneously enhancing digital literacy among women are fundamental prerequisites to harnessing the potential of digital platforms for economic engagement.

Empowering Through Financial Inclusion

The criticality of digital financial services cannot be overstated in this context. In 2022, a mere 8 percent of bank account holders were female in Pakistan, with limited familiarity with digital payment methods. Microfinancing, albeit available, has encountered limitations in fostering female entrepreneurship, primarily due to women borrowing on behalf of male relatives. Overcoming this obstacle necessitates stringent regulation and heightened awareness about digital payment avenues, pivotal in augmenting women’s access to financial services, and subsequently catalyzing increased female entrepreneurship.

Digital and Financial Inclusion: The Bedrock of Women’s Employment Opportunities

In essence, the crux of viable work opportunities for women in Pakistan pivots on digital and financial inclusion. These cornerstones not only unlock economic participation for women but also serve as catalysts for their economic independence and innovation.

The endorsement of digitalization as a transformative force requires concerted efforts to bridge the existing gender gap in digital access and financial inclusion. By fortifying these pillars, Pakistan can witness a renaissance in women’s economic engagement, transcending the confines of traditional constraints.

- Nuanced: Having subtle distinctions or variations; a nuanced understanding refers to a detailed and sophisticated comprehension that takes into account fine differences or aspects.

- Prerequisites: Something that is required as a prior condition for something else to happen or exist; fundamental prerequisites in this context refer to essential conditions that need to be fulfilled beforehand.

- Criticality: The state or quality of being crucially important or essential; it signifies the significance or crucial nature of a particular factor or element.

- Microfinancing: Providing financial services, such as small loans, savings accounts, or insurance, to individuals or small businesses who lack access to traditional banking services.

- Catalyzing: The process of accelerating or stimulating a reaction or change; in this context, it refers to the action of encouraging or speeding up women’s access to financial services and entrepreneurship through digital means.

- Renaissance: A revival, rebirth, or significant renewal of something; in this context, it suggests a reawakening or resurgence in women’s economic engagement, going beyond traditional limitations.

Credit: Farhan Khan

CSS Punjabi Complete Guide With the Book,Notes,Solved MCQs,Past Papers

The Significance of General Science & Ability as a Compulsory Subject

Ministry of Interior Jobs Opportunities 2026:Online Apply

CSS and PMS Precis Writing Rules with Complete Guide

Punjab Food Authority and Price control Jobs-Latest Job in PPSC

Ministry of Interior Jobs Opportunities 2026:Online Apply

CSS and PMS Precis Writing Rules with Complete Guide

WAPDA Job Opportunities 2026- Online Apply